The Better Fan Experience: Sports and the Business of Broadcast

Panelists discuss the changing dynamics of how people consume sports

The approximately 100 ESPN layoffs announced during NAB 2017 left panelists and audience at the convention’s “Sports and the Business of Broadcast” session sad and disappointed (the cuts follow some 300 in 2015 and 300 in 2013), but the mood soon turned positive.

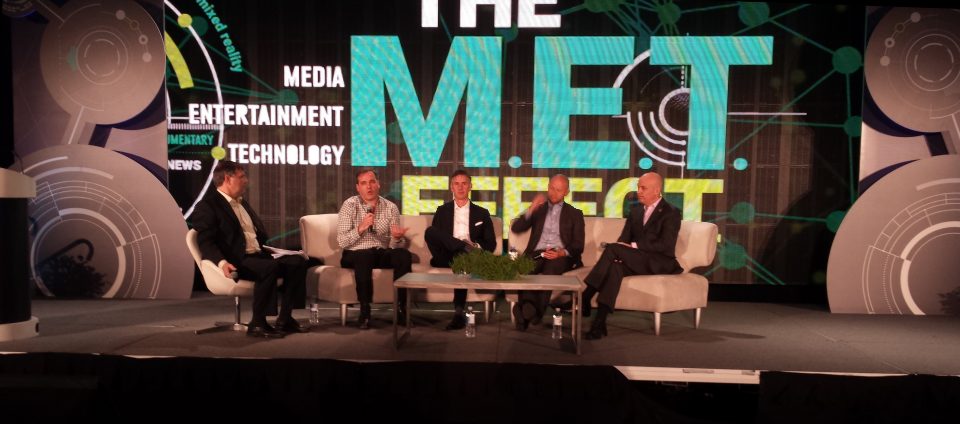

The “Sports and the Business of Broadcast” panel: (from left) moderator SportsBusiness Journal’s John Ourand, Turner Sports’ Craig Barry, NHL’s Keith Wachtel, AEG’s Todd Goldstein, and Sacramento Kings’ Chris Granger

AEG Chief Revenue Officer Todd Goldstein started off the session proclaiming himself “still bullish on broadcast.” And moderator John Ourand, media reporter for SportsBusiness Journal, pointed out that the ESPN move was a purely corporate business decision based on cord-cutting and rights fees.

Keith Wachtel, EVP/chief revenue officer, NHL, asked how the layoffs would affect Disney financially. (For the record, ESPN parent Disney stock was basically flat the week of NAB 2017, including a 1.35% drop on Monday April 24.)

Craig Barry, EVP/chief content officer, Turner Sports, observed that, with audiences and platforms fragmented and viewers experiencing fatigue, it is imperative that rightsholders negotiate and receive exclusive rights for all screens, to ensure that cord-cutters searching for content still find the rightsholders’ content. It is up to the rightsholder, he added, “to create the best user experience for the platform.” Just how to do that is still up for debate.

Although ESPN remains the worldwide leader in sports, according to Sacramento Kings President Chris Granger, sports must be viewer-centric, and appointment linear live TV is not going to go away.

In fact, consumption among cord-cutters and cord-nevers has never been higher and is increasing, Goldstein noted, adding that these people want a “great consumer experience wherever they watch.”

The monetization of content quickly moved to the forefront of the conversation, with Granger stating that engagement — watching, sharing, following — is the most important metric.

But there seems to be a disconnect between what engagement actually is in today’s multiplatform/multidevice world. Ourand points out that TV ratings for the NFL, NHL, and NASCAR are down on average year-over-year (an exception, Granger pointed out, was March Madness).

However, engagement is more than just TV ratings, and consumption on connected devices and mobile is continuing to increase. “Ratings are a traditional measurement,” Granger said, noting that March Madness delivered a higher CPM on mobile platforms. Viewers want a better experience than channel flipping, he explained, and it is up to the industry to understand this behavior in order to fully monetize content.

Goldstein pointed out that the Coachella Valley Music and Arts Festival numbers were “staggering,” providing significant engagement in different ways, and, although Coachella is a non-sports event, there’s enough interest in sports without just TV ratings.

Yet again, Ourand focused on TV ratings, predicting that ratings for the next World Series will crater year-over-year because of the Cubs’ historic win last year. Although this is just common sense, Granger stated that one year down doesn’t matter, that the focus needs to be on how to produce better content in different ways, and that the Kings’ ratings were up this year.

“Fans will decide how important an event is,” Barry said. “Live” is the appointment-TV “value,” Wachtel observed.

Granger agreed that “sports remains the most valuable content” but added that partnerships, such as with Amazon, will become increasingly important on the distribution side.

Barry concurred, as long as these types of partnerships create a better fan experience. As an example, he cited the TBS/CBS partnership on NCAA Division I Men’s Basketball Championship broadcast, which created a better fan experience with all 67 2017 games broadcast across four networks (TBS, TNT, truTV, and CBS), plus games across any platform within the partners’ respective portfolios (plus NCAA March Madness Live); the deal covers platforms to be created through 2032. That’s forward thinking from a rights-negotiating standpoint.

That brought the conversation to millennials and Twitch, a direct-to-viewer live videogame broadcasting platform (which also features competitive gaming content known as esports). “Twitch is now a real player,” said Wachtel. “They have changed the dynamics of how people consume sports.”

AEG’s Goldstein pointed out that esports venues sell out, at about 16,000 seats per event. Barry boasted about TBS’s ELeague live coverage of videogame competitions for the “casual” viewer, who may not know of or wish to find Twitch.

In the end, it came down to a simple rule from the NHL’s Wachtel: “Capture that fan.” Especially if it’s through companion viewing with different feeds on a secondary device, because fans want more than just what’s on TV.