Avid Turns to User Group for Product-Development Ideas

Story Highlights

By Dan Daley, Audio Editor, Sports Video Group

Survey ranks broadcast-sports interest in cloud tech, IP, 4K UHD, audio, and VR/AR

Media-systems developer Avid recently polled its Avid Customers Association (ACA), a customer-led user group, asking systems users in various media verticals what product development they want the company to focus on. The survey, representing more than 6,500 media professionals at more than 4,000 companies in 109 countries, uncovered key investment priorities and technology trends spanning cloud, IP, 4K UHD, audio, and VR/AR — in effect turning the user group into a focus group.

The polling, the second round of which took place early this year and was the first of its kind for Avid, was overseen and audited by the ACA Executive Board of Directors, which includes Dave Mazza, SVP/chief technical officer, NBC Sports Group.

The poll was designed to provide a deeper collaboration between Avid and its community. Participants spanned the areas of creative applications, workflow solutions, and emerging technology.

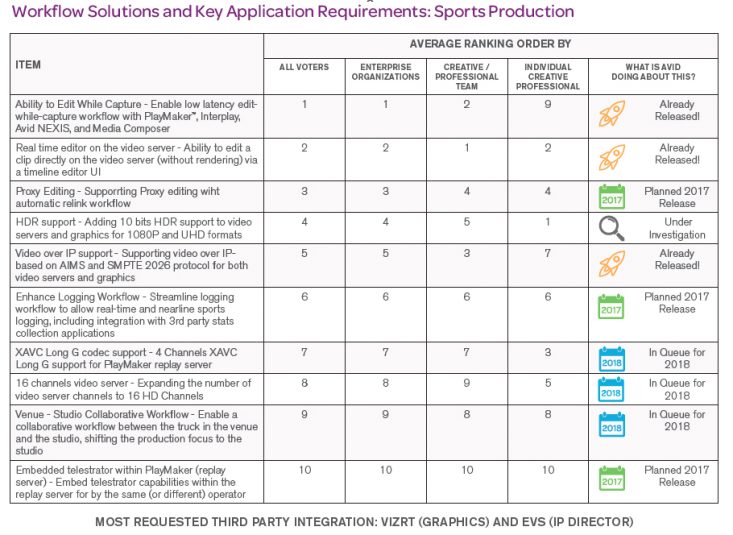

Under the rubric Workflow Solutions and Key Application Requirements: Sports Production, most respondents wanted to see several new and enhanced functions in Avid NEXIS and Media Composer platforms: the ability to edit while capturing, real-time editor capability on the video server, the ability to edit a clip directly on the video server without rendering via a timeline editor UI, and support for proxy editing with automatic relink to the workflow.

In the sound section, demand was evident for integration of immersive/3D audio via Dolby Atmos and other 3D sound formats into Avid’s foundational Pro Tools audio platform, as well as for support for stereo audio in grouped clips in Media Composer.

Improved Sports Workflows

Overall, the poll reflected a desire for faster, more efficient workflows in sports, says Avid President Jeff Rosica: “They are clearly looking for highly optimized workflows.”

He notes a few surprising results. For instance, more than 70% of respondents — most of whom were SMB or enterprise-level facilities, with a smattering of individual creatives — plan to move some or all of their workflow and infrastructure to a cloud environment over the next two years.

“We forecast closer to 30%-40% for that,” says Rosica. “That was a huge unexpected surprise.”

Avid’s Jeff Rosica: “While [the poll] won’t decide everything we do, it will significantly impact product development going forward.”

In addition, two-thirds of respondents support the idea of migrating their video to 4K UHD over the next two years, with immersive-audio formats like Dolby Atmos also scoring high.

“It’s very clear that they’re interested in immersive audio formats that complement UHD and 4K video,” Rosica notes.

Other findings include:

- The vast majority of media professionals (71.7%) are considering moving some part of their infrastructure or workflow to the cloud over the next two years, the most popular being remote-access workflows (15.8%). Just 4.8% are considering moving their entire infrastructure and workflow to the cloud, highlighting the important role that hybrid deployment models will play in the media industry’s journey to the cloud.

- A hybrid approach will be important also in the industry’s transition to IP. Just over half of respondents (50.9%) are considering hybrid SDI/IP connectivity for new investments; 26.6% are considering IP-only connectivity. Dynamic scalability is the most popular reason for considering IP video/audio (36.6%), followed by new high-bandwidth productions like UHD (28.8%) and format-agnostic workflows (16.3%).

- High-resolution media formats are firmly taking hold, with the majority of media professionals (64.6%) expecting to implement 4K UHD across their organization within the next two years. OTT or internet delivery is by far the most prevalent delivery mechanism for 4K UHD (50.7%), followed by theatrical/venue viewing (21.6%) and satellite or cable delivery (13.6%). Just 9.9% said terrestrial broadcast is their most prevalent form of 4K UHD delivery. The biggest challenge to adopting 4K is the burden on storage capacity (31.6%), followed by the cost of adding/upgrading 4K capabilities (30.5%) and the negative impact on the real-time performance of creative apps (24.7%).

- While more than half of media professionals (58.4%) said that virtual and augmented reality are important to their strategic growth plan, the vast majority (82.3%) aren’t yet sure which business models to consider, and most (63%) have no plans to implement VR/AR over the next two or three years. The most appealing applications are for entertainment (23.1%), coverage of sports events (21.25), gaming (20%), and film (19.4%). 15-30 minutes is seen as the ideal length for VR/AR programming (29.4%), followed by 5-10 minutes (25.5%), less than five minutes (18.7%), feature length (16%), and one hour (10.5%).

Interestingly, virtual reality, though high on many lists, was subordinate to more-quotidian issues, such as workflow and cost-efficiency, likely reflecting the budget concerns of networks and producers. Similarly, although immersive audio generated interest, the takeaway is that producers are more interested in ways to improve the efficiency of remote collaboration and production.

According to Rosica, the poll results have already influenced Avid product development, the first round of input spurring enhanced performance for Avid’s NEXIS shared-storage platform, as well as PlayMaker 3.5, which streamlines workflow into a single-box, single-operator solution, requiring less equipment and fewer operators. Both enhancements were announced at NAB 2017.

“[The ACA poll] has already impacted our road map for 2017,” he says. “And, while it won’t decide everything we do, it will significantly impact product development going forward.”