Why Content Discovery Is (Still) a Challenge for Sports, and Smart Speakers Are a Threat to Pay TV

New TiVo study finds some user frustrations persist in the current sports-media ecosystem

Story Highlights

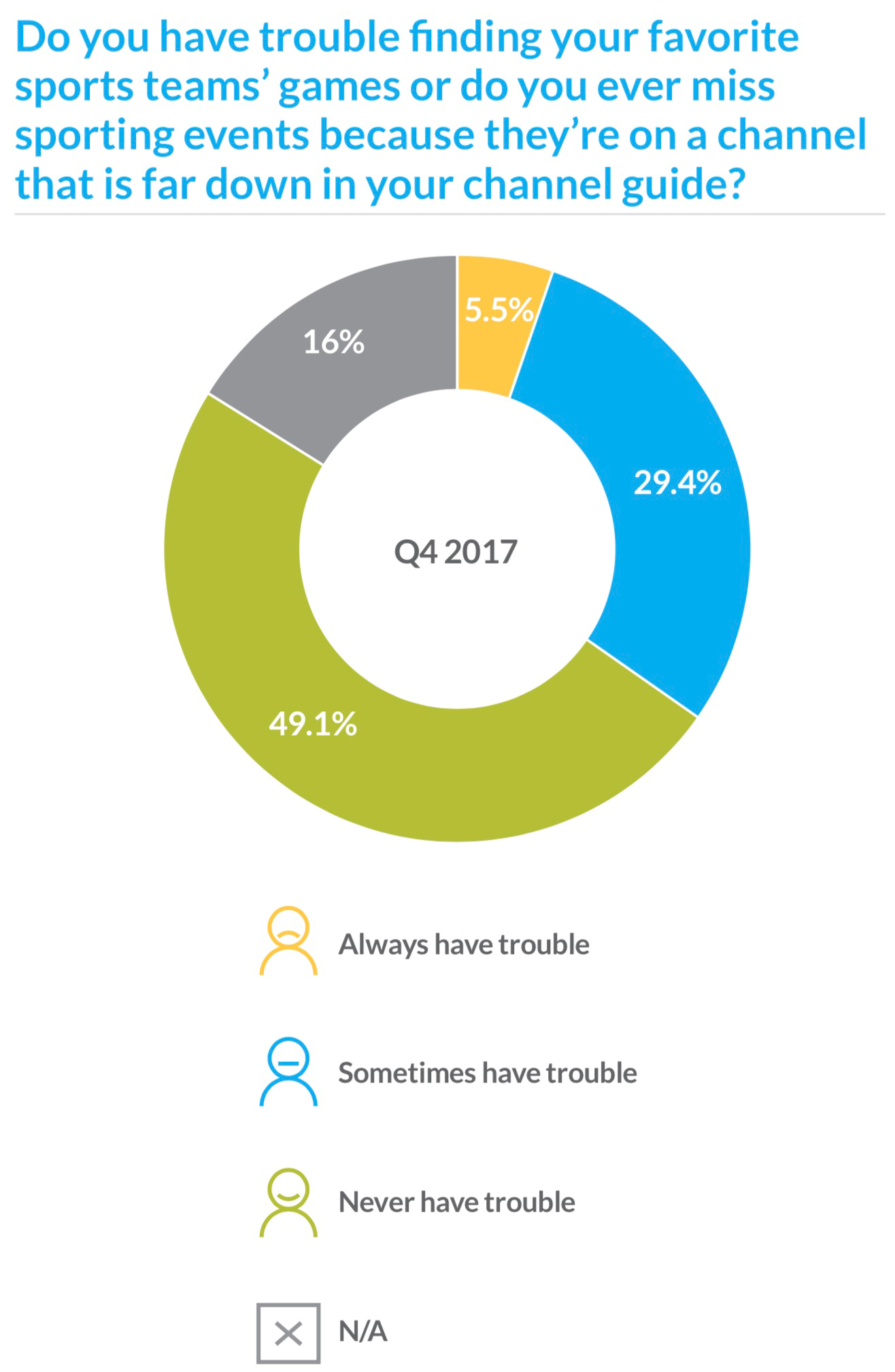

With social networks and minor cable channels buying the rights to sports broadcasts, finding a game can be frustrating — but just how frustrating? Thanks to the Q4 2017 Online Video and Pay TV Trends Report created by TiVo, we have an answer: 5.5% of adults in the U.S. and Canada are always frustrated when searching for a favorite team or event. What’s more, 29.4% are sometimes frustrated. The report notes that these numbers haven’t changed much year over year, so maybe the same 35% just doesn’t know how to Google.

Discoverability is a serious issue, of course, and, with only 49% saying they never have trouble finding games, it shows that both broadcasters and online networks need to do a better job helping fans find content — especially since online platforms are only going to increase their investment in the coming years.

Discoverability is a serious issue, of course, and, with only 49% saying they never have trouble finding games, it shows that both broadcasters and online networks need to do a better job helping fans find content — especially since online platforms are only going to increase their investment in the coming years.

“According to TiVo’s survey results, it appears Amazon and Facebook are taking the lead from a viewership standpoint,” says Chris Ambrozic, senior director, analytics and product, TiVo subsidiary Digitalsmiths, whose team wrote the analyses in the report. “Facebook is also investing in original reality-show content with various sports figures, which TiVo believes can help build awareness to their offerings. While our report covers North America, it’s worth noting [that] both Amazon and Facebook have bid on international sports content, such as cricket and soccer. This proves they are aggressively trying to reach global viewership of their streaming offerings for sports.”

According to the report, only 28.2% of respondents have ever streamed sports to a desktop or mobile device. Breaking that down, 11.5% have streamed from Facebook, 8.9% from Amazon, and 8.6% from NFL.com. The next most popular sites, in order, were NBA.com, Twitter, MLB.com, NHL.com, and MLSsoccer.com.

There’s no electronic program grid for online sports and no easy way to see what’s coming up in the near future. As a result, online networks are likely to use unconventional methods to promote their offerings.

“Marketing is going to be key for these companies, and TiVo believes it’s imperative to market the clear benefit of their services/offerings to gain viewership,” Ambrozic says. “Amazon took an interesting stance in Q3/Q4 of 2017 by leveraging their existing, and large, Prime subscriber base to promote their Thursday Night Football offerings on the outside of their shipping boxes. Facebook could also have a sizable audience to market its streaming offerings to once their reality sports shows air, especially since they are sports fans who are currently watching a TV show about a prominent sports figure.”

TiVo’s report is aimed at traditional pay-TV services and sees online streaming not as a natural evolution of how people enjoy TV but as a threat to existing companies. It points out that the Floyd Mayweather-Conor McGregor match in August was one of the first big fights that fans could purchase directly online, rather than going through a pay-TV provider, and that Facebook is spending big on sports licensing. This could damage broadcasters’ investment in sports by siphoning off fans and lowering ad revenues, the report says. It could also entice some fans to cut the cord in favor or lower online options.

Is OTT stealing viewers from pay TV?, the report asks. It’s an odd questions when pay-TV companies are creating steaming services, and broadcasters have shown a willingness to embrace sports streaming, such as with NBC’s live Olympic offerings.

Digitalsmiths’ Chris Ambrozic: “Both broadcast networks and pay-TV providers should be concerned about the data [that] smart-speaker manufacturers can gather from users who check sports scores on their devices.”

Streaming options aren’t the only thing TiVo sees as a threat to pay TV. It alleges that smart speakers are a gateway to streaming sports, as if sports streaming were a nasty habit fans could catch from Alexa. Respondents who watch four or more hours of sports per day are 191% more likely to check sports scores via a smart speaker, the report says, compared with respondents who watch zero to two hours per day. When people check scores, the report reasons, they’re showing that they’re fans of certain teams or sports and giving online companies a way to market to their interests.

“Both broadcast networks and pay-TV providers should be concerned about the data [that] smart-speaker manufacturers can gather from users who check sports scores on their devices,” Ambrozic says. “This data can be leveraged to deliver targeted marketing to these users. For example, if an Amazon Echo device is asked for the score of the New England Patriots game, Amazon now knows that this household is likely interested in not just football but the New England Patriots specifically. With this insight, it would make sense for targeted ads promoting Amazon’s Thursday Night Football stream to be delivered to this household.”

And that’s another threat to the pay-TV subscriber base. But whether readers see this as a hazard or an opportunity depends on whether they’re coming from the pay-TV or OTT world.