Esports Entry Advisory Releases Survey Findings Taking Pulse of a Post-COVID-19 Gaming Industry

Story Highlights

The impact of COVID-19 on the travel, sports, and entertainment industries cannot be understated. Thousands of live events scheduled to occur over the next several months have been canceled worldwide, including many in- person esports tournaments. To monitor the impact of such trends on behalf of our clients and the broader public assembly facility industry, the Esports Entry Advisory (EEA) has prepared the following report to summarize how the pandemic has affected the esports industry thus far and to convey insight provided by significant stakeholders (tournament and league organizers, teams, publishers, and others) throughout the industry.

Impact on Traditional Sports Industry

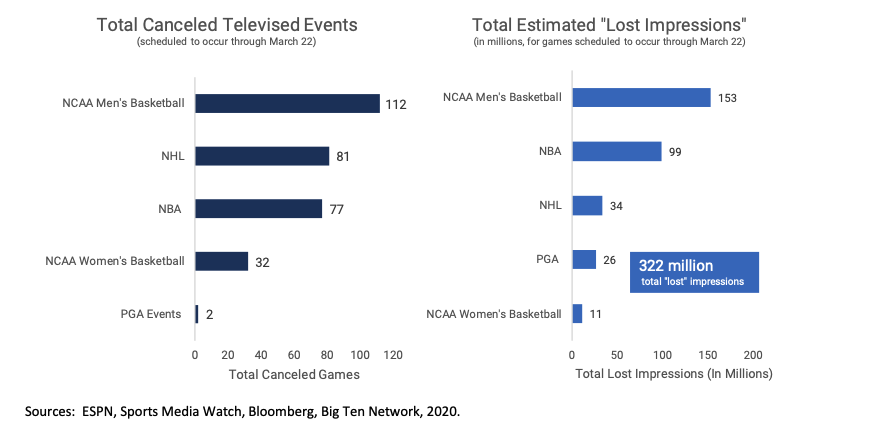

The EEA begin with a high-level summary of how many televised sports industries have been affected by the COVID- 19 outbreak, observing the period between March 9 and March 22 of 2020. The charts below present the total number of televised sporting events scheduled to occur during this period, along with the theoretical “lost impressions” figures, based on average viewership per game data provided by resources such as Sports Media Watch and ESPN. In this case, “impressions” represent views of a televised or streamed broadcast.

As outlined above, 112 NCAA Men’s Basketball games were scheduled to be televised as part of conference playoffs and the NCAA Tournament (which was scheduled to start March 17). Eighty-one NHL games and 77 NBA games were also scheduled, in addition to 32 NCAA Women’s basketball games and two PGA Tournaments (Players Championship and Valspar Championship).

Based on average viewership data from previous years, the EEA estimate that 153 million impressions were “lost” due to the cancellation of the 112 NCAA Men’s Basketball games. In total, over 322 million impressions were “lost” due to canceled events, highlighting the significant impact of the virus on the live entertainment industry. How and whether viewers are finding alternative content is an essential subject for the esports industry.

Impact on Esports Viewership

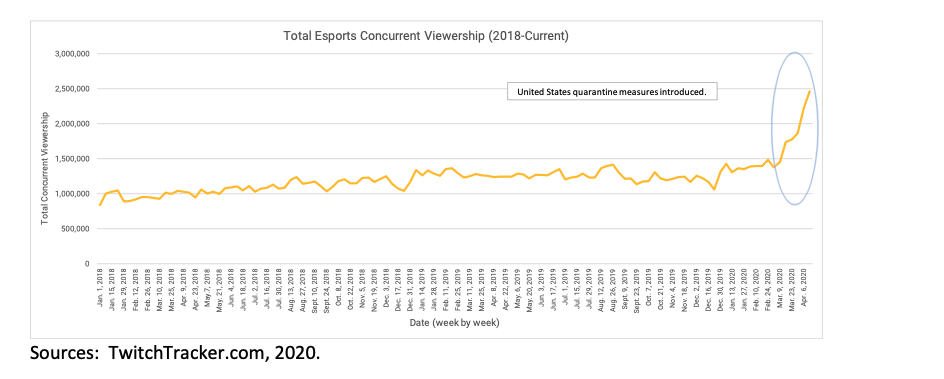

The chart below summarizes the weekly viewership of Twitch, as recorded by TwitchTracker, a third-party website that tracks the number of unique viewers of Twitch on a 24/7 basis. As shown, Twitch viewership averaged nearly 2.5 million unique viewers at any given moment as of the week of April 13, 2020, a 79 percent increase from the weekly average of 1.4 million during the four weeks before the week of March 16 the EEA expect this growth pattern to continue while the traditional sports sector is dormant.

Several factors contributed to this rapid increase; students no longer attending in-person school, college or university now have more free time; young professionals working from home currently can shift to watching or participating in esports events at the click of a mouse; and, there is simply more current content being produced for online streaming formats.

As a result, more people are tuning into alternative media channels for entertainment. This trend is articulated by news headlines across the industry, including:

- Sensor Tower, a research firm, shared data that showed sharp increases in first-time Twitch app downloads in Europe. Downloads in Greece, Italy, and Spain saw increases of 50 percent, 41 percent, and 26 percent week-over-week, respectively, over the past seven days.

- YouTube Gaming viewership was up by 15 percent during the week of March 16.

- Esports team organization, Gen.G, has seen an 18.2 percent bump in Chinese viewership over the last two months on live streaming sites Douyu and Huya.

- The first day of the ESL Pro League, which features the game Counter-Strike: Global Offensive, reported an audience increase to 146,000 viewers for March 16’s matches, compared to 115,000 a year ago, a 27- percent increase.

- Like other esports, CS:GO has had to cancel events due to the virus, particularly the Intel Extreme Masters in Katowice earlier this month, though its peak viewership reached over a million, making it one of the most-watched tournaments in the esports history.

- Gaming as a whole is also seeing a boost, as evidenced by the all-time high number of concurrent users on the gaming platform Steam on March 15, with 20 million online and 6.2 million in-game.

- The new Call of Duty Warzone reached 30 million players on March 20, ten days after its launch. The game had 15 million players within its first week, a figure that quickly doubled after more significant quarantine measures were put in place.

- On April 2, FanDuel announced it was partnering with The Drone Racing League to develop a fantasy league based on Drone Racing League Simulator play. The public can now “draft” professional players competing in online drone racing simulations for a chance to win cash prizes.

At the same time, the traditional live sports and entertainment sectors developed online events, organized as quickly as within one week, replacing previously planned in-person sporting events with streamed esports experiences. Several headlines demonstrate this phenomenon:

- NBA 2K 3-on-3 Tournament – Starting on March 27, the NBA 2K League has been hosting The NBA 2KL Three for All Showdown, a 3-on-3 tournament that pits top fans, influencers and top female 2K players playing in the NBA 2K20 MyPark game mode for the opportunity to challenge NBA 2K league teams.

- NASCAR Simulation Race –With all NASCAR Cup Series races through May 3 postponed, NASCAR created the eNASCAR iRacing Pro Invitational Series, which features virtual races between professional NASCAR drivers. Nielsen data show that the Series’ first online event generated 903,000 views, growing to 1.3 million views for the second event the following week. This represents an impressive 62 percent of the televised audience of 2.1 million per race last year for real-life NASCAR Cup Series events on FS1.

- Virtual Australian Grand Prix – In response to the cancellation of the actual F1 Australian Grand Prix, Veloce Esports hosted the “Not the Aus GP”, a virtual racing event built around the game “F1 2019”. Real F1 drivers competed with top gamers, and other influencers in a virtual race broadcasted on Twitch and YouTube. Formula 1 then announced the launch of a new F1 Esports Virtual Grand Prix series, featuring real F1 drivers. The series “has been created to enable fans to continue watching Formula 1 races virtually, despite the ongoing COVID-19 situation that has affected this season’s opening race calendar.”

This highly unusual period has created an opportunity for the esports sector to introduce itself to millions of traditional sports fans throughout the country and around the globe. This notion was further explored with esports stakeholders, as discussed below.

Insight from Industry Stakeholders

The EEA have collected input from 23 critical stakeholders in the esports industry. The list of interview respondents includes title publishers/game developers, team representatives, league operators, tournament organizers, production service providers, talent/influencers, competitive drone racing organizations, and several other contributors and beneficiaries of esports. These survey participants were asked several questions focusing on areas that include the following:

- Estimates of the number of live esports events they were scheduled to be involved with in 2020

- The number of previously planned live events that have been canceled, postponed or moved to an online format due to COVID-19

- Estimates as to the incremental viewership and engagement levels on their various platforms (websites, streaming and social media channels) since quarantine measures have been initiated

- Their opinion on the trajectory of the live esports event industry going forward after the COVID-19 pandemic has subsided

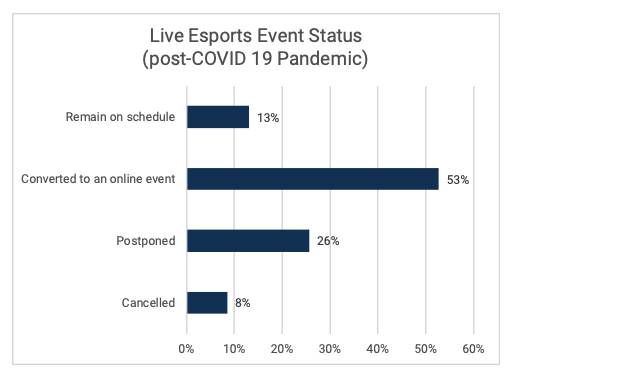

Interviewed respondents represented a total of over 560 live esports events that were scheduled to take place at some point during the remainder of 2020. Of their initially planned live events, stakeholders were asked to indicate which were postponed to a later date, converted to an online-only format, canceled altogether, or remained scheduled. The following chart summarizes their feedback by the percentage of the 560+ events represented.

More than half of live esports events represented (53 percent) have already converted to an online-only format, far outnumbering those that have been postponed (26 percent), canceled altogether (8 percent), or are still scheduled to take place as a live event (13 percent). This snapshot reflects the unique resilience of the esports industry during these very trying times for other in-person sports and entertainment sectors. Esports organizers have quickly adapted and are now hosting their events online, where the world’s best talent will still compete across a variety of titles in front of a rapidly expanding virtual international audience.

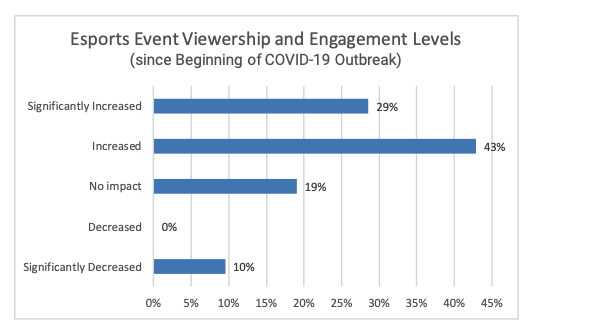

Interviewees were asked to indicate how viewership or engagement with their channels, platforms, and other forms of content have been affected since the COVID-19 outbreak. Their responses are summarized below.

Seventy-two percent of respondents indicated that their viewership levels have increased during the pandemic, with 29 percent registering a significant increase during this time period. Nineteen percent of stakeholders have noticed no impact, while the remaining ten percent cited significant decreases in such viewership and engagement. It should be noted that this last group includes a number of collegiate esports organizations, a segment that has perhaps faced more complex logistic and athlete eligibility issues during this challenging period.

Surveyed stakeholders were asked to describe their outlook on the future of the live esports event industry after the threat of the COVID-19 pandemic has subsided. Their feedback was mixed – some planners thought the live event industry would be slowed by the economic aftermath of the pandemic, while a majority were more optimistic and suggested that the industry will quickly rebound to previous levels or even accelerate in its growth trajectory.

Those who thought that the industry will quickly rebound, or might accelerate in its growth, provided the following comments:

- “People are going to desperately want to attend events after this.”

- “Pent up demand for a social activity will see events bounce back reasonably quickly but perhaps not immediately.”

- “Online access may showcase that more people can participate in events and have the same experience. That is our goal.”

- “I believe more people will gain a better understanding of esports during this time, and the interest that follows will grow in-person attendance ongoing.”

- “I believe an entire new mainstream audience will emerge.”

These observations indicate that, as a result of behavioral and economic shifts brought on by an international pandemic, the esports live events industry may suffer less negative impact relative to other entertainment industries. However, there is still some uncertainty as to how its growth trajectory may be affected. Surveyed stakeholders acknowledged that new fans are being introduced to the concept of spectating competitive esports events across a variety of titles such as Overwatch, League of Legends, Call of Duty, NBA 2K, Counter-Strike: Global Offensive, Rocket League, F1 2019, and others, and as a result may be more open to the idea of attending an event in person once large gatherings are considered safe again.